The COVID-19 Pandemic of 2020-2022 (A): Democracy, Inequality, and Capitalism

Encyclopedia: Democracy, Inequality, Capitalism

The COVID pandemic of 2020-2022 was a cascade of crises: humanitarian, economic, and even political. The virus claimed the lives of 6.61 million people world-wide over two years and infected some 501 million. Some of the survivors experienced “long COVID,” lingering and debilitating symptoms. The pandemic triggered difficulties of mobilizing and managing complex systems to treat the affected population in the face of large surges in need for health care. Indeed, much public policy during the two years was motivated by the aim of preventing national health care systems from being overwhelmed by caseloads. The pandemic triggered heroic efforts to decode the genome of the virus, derive drugs to quell the virus, prove the efficacy of the drugs to regulators, and invent new manufacturing techniques to produce the drugs, and inject the vaccines into a recalcitrant public—all within less than a year.

The pandemic also spawned severe economic challenges. A financial crisis in March 2020 threatened the system of markets and financial institutions by which credit—the lifeblood of the world economy—functions. An economic recession ensued from the virus and the lockdowns in human activity. Finally, asymmetries in the distribution of vaccines, the retention of jobs by women and minorities, and the delivery of social safety net payments heightened a crisis of inequality. These various crises raised questions about democracy, inequality, and capitalism.

This case study gives an overview of the crisis of 2020-2022 with particular focus on some questions that the crisis raised.

- This (A) case provides an overview and invites an investigation of the relationships among democracy, economic inequality, and income.

- The (B) case addresses the extreme volatility seen in financial markets in 2020—to what extent was this volatility associated with objective news, as opposed to the “noise” of typical daily trading?

- The (C) case regards policy proposals for extended fiscal and monetary stimulus—from history, what seemed to be the relationship between these two kinds of economic stimulus and inflation in consumer prices?

- The (D) case examines the possible changes in income inequality from 2019 to 2021.

Uncertainty: Impact and Response

Historical research found that pandemics resulted in massive social and economic changes. Three previous health crises gave clues to what might happen during the COVID pandemic. The first crisis was the influenza pandemic of 1918-1920, which imposed “health effects [that] were large and diffuse…killed 50 million people, with some estimates sugging the death toll could be as high as 100 million.”2 It was associated with the onset of economic contractions.3 GDP per capita fell 7.6% from 1918 to 1921.4 And it overwhelmed the medical system, producing shocking declines in treatment. The pandemic disproportionately killed working-age adults, imposing a negative labor supply shock on the economy.

The second example to which analysts referred was the bubonic plague pandemic (the “Black Death”) that ravaged Europe from 1346 to 1353. It produced a sharp decline in the labor pool and a rise in real wages. Labor shortages led to the end of serfdom in Europe and strengthened the growth of guilds and craft associations. And the plague reduced economic inequality. Economist Guido Alfani wrote that “Black Death triggered one of a series of “Kuznets waves” in inequality detectable throughout history…rising inequality before the pandemic and inequality decline thereafter make for a perfect inverted U path.”5 6

And the third example was the cholera epidemic in London in 1854 that claimed over 10,000 lives. This was part of a global pandemic from 1846 to 1860. A geolocational study by John Snow determined that the disease spread rapidly from tainted water found at a water well in the Soho neighborhood. One modern study of the economic impact of the epidemic found that it triggered out-migration from that neighborhood, losses in real estate values, and the redistribution of poverty across London.7

The early days of the COVID pandemic showed signs of causing a dramatic economic setback. In 2020, governments in the U.S. and elsewhere imposed “lockdowns” that closed businesses, schools, government facilities, public transportation, and general medical care. The aim was to suppress the rate of infection in the general population to relieve strains on the healthcare systems. The loss of revenues by businesses threatened layoffs, a large wave of bankruptcies, and a “work from home” ethic.

The Crisis and Recovery

Exhibit A1 shows that over 2020-2022, the pandemic had surged in waves. By November 2022, the virus had infected 97.7 million in the U.S. and claimed 1,072,223 lives.7 However, the aggregate figures hid some notable asymmetries in how segments of the population experienced the pandemic—this aspect is discussed in the (D) case.

In late February 2020, the U.S. financial markets (Exhibit A2) began a dramatic selloff—a “dash for cash”—even before the implications of COVID-19 became widely known.8 The market in U.S. Treasury securities—the most liquid and stable of all financial markets in the world–witnessed strong selling pressure. Globally, investors’ “dash for cash” specifically sought U.S. dollars as a safe harbor during the pandemic. Accordingly, the dollar appreciated dramatically against foreign currencies (Exhibit A3).

A dispute over oil production between Russia and OPEC triggered a price war that began in early March. The price of oil dropped from about $60 per barrel to about $20, an historic decline dwarfed only by the price slump in 2008. The turmoil in the oil market prompted declines in financial and commodity markets.

Following a series of aggressive changes in monetary policy by central banks, national legislatures took action to stimulate their economies and help the less fortunate absorb the shock of the pandemic–countries differed in the mix of policy actions (e.g., monetary vs. fiscal). On March 23, Jerome Powell, Chairman of the U.S. Federal Reserve declared that the Fed would act aggressively to support orderly markets–observers remarked that this was the first time that the Fed had declared an open-ended “do whatever it takes” stance toward a financial crisis. On March 27, the U.S. Congress enacted the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) which authorized the government to spend up to $2.7 trillion to support individuals and firms through the crisis. The fiscal and monetary policy actions marked the nadir of the U.S. financial market crash. From February 19 to March 23, the S&P500 Index had lost 34% of its value, or about $9.5 trillion.

Despite the sudden crash, the stock market recovered to pre-crisis levels in August 2020. The U.S. economy returned to pre-pandemic levels of Gross Domestic Product (GDP) per Capita (a conventional measure of economic output) by April 2021 (Exhibit A4). However, permanent jobs lost in the recession were not recovered until July 2022 (Exhibit A5). Indeed, it appeared that a major restructuring of the U.S. labor market was under way in view of a sharp increase in the number of workers quitting their jobs, in what was called “the great resignation.”

These events spawned increased debate about the economic consequences of the pandemic. Four issues were pertinent: financial market stability, government finance, inflation, and economic inequality.

Conclusion: Some Problems and Policy Debates

Data from the pandemic years highlighted questions that policymakers and scholars had long debated, such as:

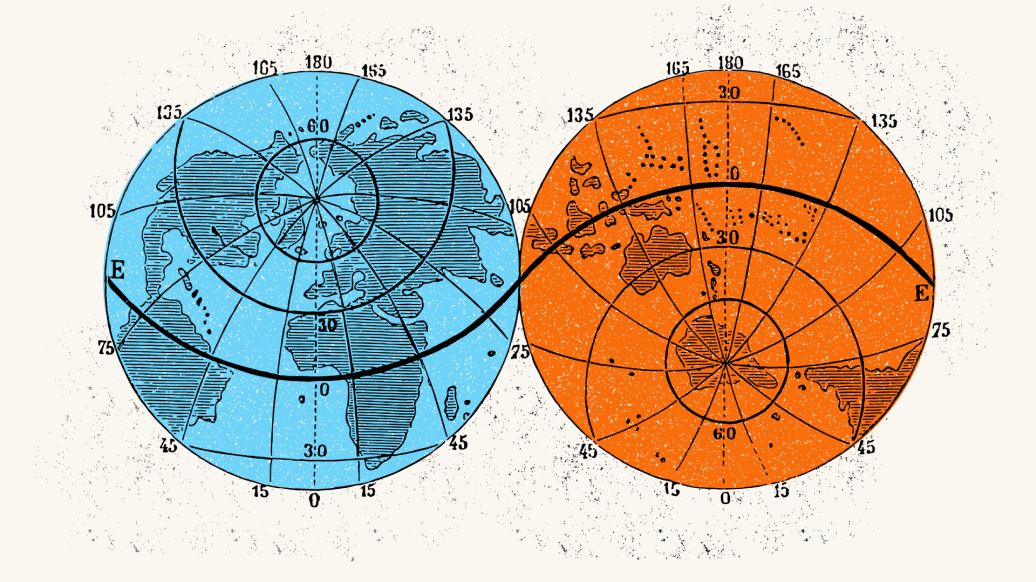

- To what extent was income inequality a function of the prosperity of an economy or of the degree of democracy in government? Over the years, 2019 and 2020, what was the correlation coefficient between the Gini Coefficient for a sample of 54 nations and their GDP per capita or a measure of their democratic strength? Using data in Exhibit A6 in “COVID2020 STUDENTv21.xlsx,“

- Estimate the correlation coefficients for 2019 and 2020 between the Gini Coefficient, GDP per capita, and the Democracy Index.

- Graph a scatterplot diagram of the observations for 2019 and 2020 and project trendlines through the data for 2019 and 2020.

- Interpret the results.

- What accounted for the meltdown of financial asset prices in March 2020, and their sharp rise in April-May? A debate had raged for decades between those who argued that financial markets are essentially rational and efficient in setting prices, and others who held that financial markets were non-rational and even irrational. To what extent were the changes in the prices of financial assets in March-April 2020 a rational response to news, as opposed to “noise”? The (B) case invites analysis of daily returns on the S&P500 Index to assess this subject.

- Would fiscal and monetary stimulus by the U.S. government affect the rate of inflation in consumer prices? Four acts of Congress and various Executive Orders authorized $6.3 trillion in spending aimed to offset the effects of the pandemic and lockdowns. Similar emergency policies adopted by the Board of Governors of the Federal Reserve System added $4.7 trillion to the Fed’s balance sheet. While it was not possible to foresee the possible impact of these stimulus policies, historical data might provide insights for the future. The (C) case in this series affords historical data from which to test for any association between fiscal and monetary policy changes and consumer price inflation.

- How did measures of pre-tax income inequality in the U.S. change from before (2019) to after (2021) the pandemic? The history of global pandemics suggested that they were economic shocks that tended to reduce inequality. Was this true for the U.S. over the 2019-2021 period? And was the impact of the pandemic on incomes spread equally across the U.S. society? The crisis stimulated debates about economic inequality, disparities in unemployment, precarious exposure to COVID, and variations in vaccination and health care. The (D) case in this series provides data from which to estimate changes in income inequality associated with the pandemic years.

Exhibits

Exhibit A1

The Humanitarian Toll: 7-Day Moving Average of Reported Cases of COVID Infection in the United States

View Exhibit A1Exhibit A2

Bond Yield Spreads over Treasuries and S&P500 Index

View Exhibit A2Exhibit A3

The Exchange Rate of the U.S. Dollar for a Basked to Foreign Currencies (Number of Units of Foreign Currency per U.S. Dollar)

View Exhibit A3Exhibit A4

Trend of U.S. Gross Domestic Product per Capita

View Exhibit A4Exhibit A5

The Span of the Pandemic-Induced Crisis as indicated by changes in stock prices, GDP per capita, jobs lost, COVID deaths, and recession months

View Exhibit A5Exhibit A6

Measures of Inequality, Income, and Democracy across a Sample of 57 Countries, 2019 and 2020

View Exhibit A6Notes

1 Data on global COVID cases and deaths at November 2022 are from Johns Hopkins Coronavirus Resource Center, https://coronavirus.jhu.edu/. This figure reflects official tallies, and may understate considerably the actual amount, as acknowledged by the World Health Organization (see https://www.who.int/data/stories/the-true-death-toll-of-covid-19-estimating-global-excess-mortality).

2 Beach, Clay, Saavedra (2020) 42.

3 Outbreaks of the influenza pandemic in the U.S. were first detected in March 1918 and continued in waves until April 1920. The pandemic coincided with two recessions: one of seven months that began in August 1918 and another of 18 months began in January 1920. The Armistice and demobilization from World War I also contributed to the timing and duration of the second recession.

4 The decline in GDP er capita in the U.S. from 1918 to 1921 is estimated from data given in Maddison Project Database, version 2020. Bolt, Jutta and Jan Luiten van Zanden (2020), “Maddison style estimates of the evolution of the world economy. A new 2020 update ”.

5 Alfani (2022) 13.

6 A Kuznets Wave (named for its discoverer, Simon Kuznets) is an inverted ‘U’, plotted with income per capita on the horizontal axis and economic inequality on the vertical axis. Kuznets used the wave to describe how inequality in middle-income countries would develop as their economies grew. The wave suggests that economic inequality first rises as an economy industrializes and grows; and then inequality declines as an economy matures. The rising stage reflects growing investment opportunities for the wealthy on one hand, and on the other the emigration of cheap labor from rural areas, which tends to depress labor wage rates. Eventually, Kuznets argued, industrialization, democratization, trade liberalization, and income redistribution would increase per-capita income for all, leading to a decline in income inequality. Since the late 20th century, the Kuznets wave has described less well the changes in economic inequality as global real income per capita has risen. Ultimately, only time would tell whether the COVID pandemic would truly trigger another systemic decline in income inequality.

7 Ambrus, Attila, Erica Field, and Robert Gonzalez. 2020. “Loss in the Time of Cholera: Long-Run Impact of a Disease Epidemic on the Urban Landscape,” American Economic Review, 110(2): 475-525.

8 Note that a rise in bond yield equates to a decline in bond prices